Budgeting and finances. Two cringe-worthy words. Learn how to easily make a budget to help you reach your financial goals! It’s easier than you think!

I feel like we do fairly well with our money and the way that we choose to use it. Granted, over the years we have had some impulse buys or made some not-so-wise decisions, but overall, I feel like we do well.

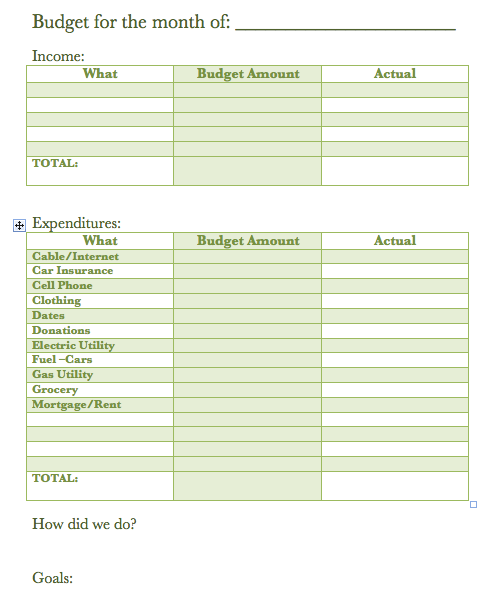

Because we had a consistent history of making good choices with our money, we had left out a key ingredient: a budget. Together, we decided to create a budget and track how our money was being spent (better late than never, right?). This budget has helped us average out what we were spending, examine, and be better managers of our money.

How to Create a Budget

Track

Write down every penny that you spend for a month.

I think 3 months gives you a good picture of what real life is like. I like to take the 3 months and average them out to create the Budget Amount.

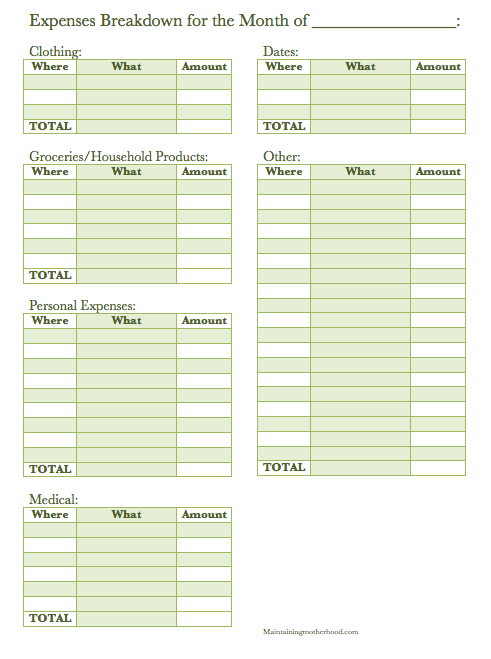

On my Expenses Sheet, I have included categories for:

- Clothing: Shoes, kid clothes, my clothes, underwear, socks, etc.

- Groceries: Included in our grocery budget are all cleaning supplies and toiletries.

- Personal Expenses: Many couples we have talked to have their own personal budgets. We thought we would set this up as a category this year to help us define both what is considered a personal expenditure, and how much our personal budgets should be.

- Medical: Medical expenses don’t seem to be something that you can plan on per se, so I created this spot to jot down co-pays, glasses, prescriptions, etc. Also, this will help to have all the medical expenses in one easy place come Tax time next year. This also helps you better track your money spent in this category for your HSA budget for the next year.

- Dates: We NEED to have dates!

- Other: This might seem like a pointless category, but this is my favorite! The purpose of this category is to recognize trends. You can see where you need to set up another category to specifically budget for, or a place that you are spending WAY too much money.

Examine

Look for trends both good and bad. Identify where to spend and where not to spend.

Boy has this examining part been interesting. We have a few general rules in place such as consulting each other before a large purchase (over $25) is made that is outside of the normal budget parameters. But wouldn’t you know it, the one thing that shoots us in the foot isn’t the large purchases or the impulse buys. We found that the trend is the good old ‘nickel and dime’ dance.

I’m not much of a receipt saver, so I created a sheet that I would write down each time I spent money. I would write down where I shopped, how much I spent, and what I purchased. At point one I noticed the Dollar Store was probably staying in business because of me! I didn’t realize how often I was going there until I looked back on the month. I never actually ‘need’ anything from the Dollar Store, so I banned myself from the store.

I noticed the same type of trend with small ’emergencies’ that would come up. “Mom, I NEED (fill in the blank)”. And then we would go to the store and I would stand in the checkout line wondering if they were going to have to restock after I left!

My point is this: If you keep a record of what you spend (and review it), you tend to

-

Be more accountable for what you spend.

-

Spend less. Which in turn means, you save more!

Create the Budget

Using your data, set goals for where your money will go.

Write the goal down and commit to stick to it!

There are many different budget trackers out there, but I like making my own. That way it is more customizable. I included all the fixed expenditures we have each month like the mortgage and utilities. There are blank spaces for you to put your own personal expenses on. There is also a spot to include your goal. If you want to save money toward a specific goal, or stop eating out so much, this is the spot to write the goal so you can have the visual reminder.

The most important part about having a budget is to review it! A budget it not a set in stone document. It is a constantly changing thing. Emergencies happen. Family size increases or decreases. Everything is constantly changing, so understanding that your budget will change too is important.

What helps you keep your budget on track?

I love this. My husband and I just started budgeting !

Good for you! Stick with it, and don’t hesitate to review and change your budget as necessary!